Insights

What is Commodity Brokerage and How it Works

Dresyamaya Fiona

•

7 Minutes

read

•

Dec 9, 2025

As intermediaries in the commodity market, brokers help traders access futures contracts, physical goods, and relevant market data. They handle trade execution, clearing, and risk management processes that keep transactions running efficiently.

In the rapidly evolving global marketplace, commodities are vital to powering economies, facilitating the movement of goods, and influencing investment approaches. However, many individuals and businesses find it difficult to engage directly with these markets. This is where commodity brokerage services come into play. Gaining insight into what commodity brokerage entails, its functions, the types of commodities traded, and how it operates can assist you in making more informed trading choices.

What is Commodity Brokerage?

A commodity brokerage is a firm or service that provides traders, investors, and companies with access to commodity markets. These firms act as intermediaries, enabling clients to buy and sell various commodity-based financial instruments such as futures, options, and swaps. Commodity brokerages are typically licensed and regulated by government authorities to ensure transparent, secure, and compliant trading activities.

In simpler terms, a commodity brokerage connects you to the marketplace, offers the tools to trade, and helps manage the entire process, whether you're hedging risk, speculating on price movements, or gaining exposure to global commodities.

What Do Commodity Brokerages Do?

Understanding what they do is key to appreciating the value they provide. Commodity brokerages offer several essential services:

1. Market Access

Commodity brokerages give clients access to major global exchanges such as CME Group, ICE, and LME. This allows traders to participate in markets that would otherwise be inaccessible without a licensed intermediary.

2. Order Execution

Brokerages accept buy or sell directives from clients and execute those trades at the best available market prices. Some firms utilize advanced electronic platforms, while others combine technology with human expertise through voice execution.

3. Advisory and Research

Many commodity brokerages provide market insights, analytics, and research reports. These cover supply-and-demand trends, macroeconomic drivers, price forecasts, and trade recommendations.

4. Risk Management

A significant function of commodity brokerage helps businesses hedge against price volatility. For example, an airline might hedge jet fuel costs, or a coffee producer might secure pricing in advance.

5. Clearing and Settlement

After a trade is executed, it must be processed, recorded, and settled. Clearing services ensure that transactions are accurate, secure, and compliant with regulatory requirements.

6. Compliance and Regulation

Commodity brokerages ensure that all trading activities follow the rules set by authorities such as the CFTC, MAS, BAPPEBTI, or FCA. This protects clients from market manipulation and misconduct.

Read also: 10 Different Types of Commodities You Should Know

What Commodities Are Traded Through a Brokerage?

1. Energy Commodities

● Crude oil (WTI, Brent)

● Natural gas

● Gasoline

● Heating oil

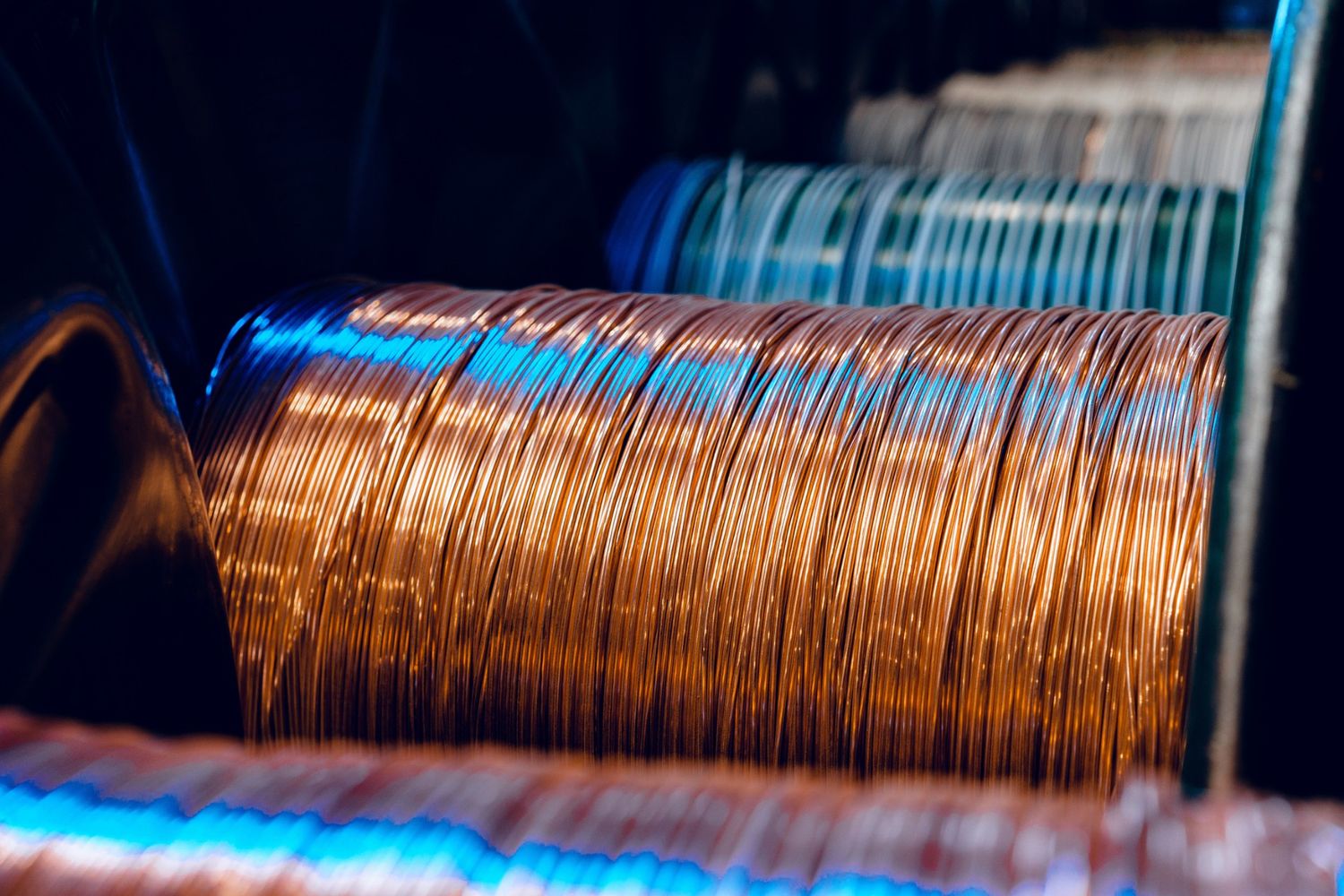

2. Metals

● Gold

● Silver

● Platinum

● Copper

● Aluminum

Precious metals serve as safe-haven assets, while base metals support industrial production.

3. Agricultural (Soft Commodities)

Soft commodities are heavily affected by weather conditions, climate risks, and global consumption trends.

4. Grains and Oilseeds

● Wheat

● Corn

● Soybeans

● Soybean oil and meal

These markets are essential for global food supply and biofuel production.

Some commodity brokerages also provide access to exotic products, OTC derivatives, and environmental markets, such as carbon credits and renewable energy certificates.

How Commodity Brokerages Operate

To truly understand the industry, it’s essential to look at how it operates on a day-to-day basis. Commodity brokerages rely on a combination of technology, regulatory frameworks, and market expertise.

1. Client Onboarding and Compliance Checks

Before trading begins, brokerages conduct Know Your Customer (KYC) checks, verify identity documents, and assess a client’s financial suitability. This ensures the trading relationship is secure and compliant.

2. Trading Platforms and Market Connectivity

Most brokerages provide electronic trading platforms where clients can:

● Analyze charts

● View real-time prices

● Enter and manage orders

● Monitor risk exposure

Institutional clients may also trade through FIX APIs or voice broking with senior traders.

3. Trade Execution and Routing

Once an order is placed, the brokerage routes it to the appropriate exchange. Algorithms may help achieve best execution, reduce slippage, or manage complex spread strategies.

4. Margin and Risk Controls

Commodity markets typically use margin-based trading. Brokerages monitor:

● Margin requirements

● Account balance

● Market volatility

● Open positions

This prevents excessive risk-taking and supports market stability.

5. Clearing and Settlement

When a trade is executed, clearinghouses guarantee the transaction. Brokerages manage this process behind the scenes, ensuring accuracy and timely settlement.

6. Ongoing Support and Reporting

Brokerages provide clients with daily statements, transaction histories, pricing insights, and regulatory reports. This supports transparency and informed decision-making.

Read also: What is a Tradable Commodity? A Complete Guide

Why Commodity Brokerage Matters

Commodity brokerages bridge the gap between global markets and the individuals or businesses who need to access them. Whether you're hedging agricultural risks, investing in precious metals, or trading energy futures, a brokerage provides the structure, expertise, and technology needed to navigate the complexity of commodity markets.