Insights

Understanding Metal Commodities and Their Role in the Market

Dresyamaya Fiona

•

2 minutes

read

•

Apr 29, 2025

Metal commodities are far more than raw materials, they are foundational to economic growth, technological advancement, and global trade.

In today's interconnected economy, metal commodities are critical in shaping nations' infrastructure and industrial strength. From construction and electronics to automotive and energy sectors, metals are essential raw materials driving modern civilization. With the growing demand for innovation and sustainable development, the performance of metal commodities has become a key indicator of economic health and trends in the global market.

What Are Metal Commodities?

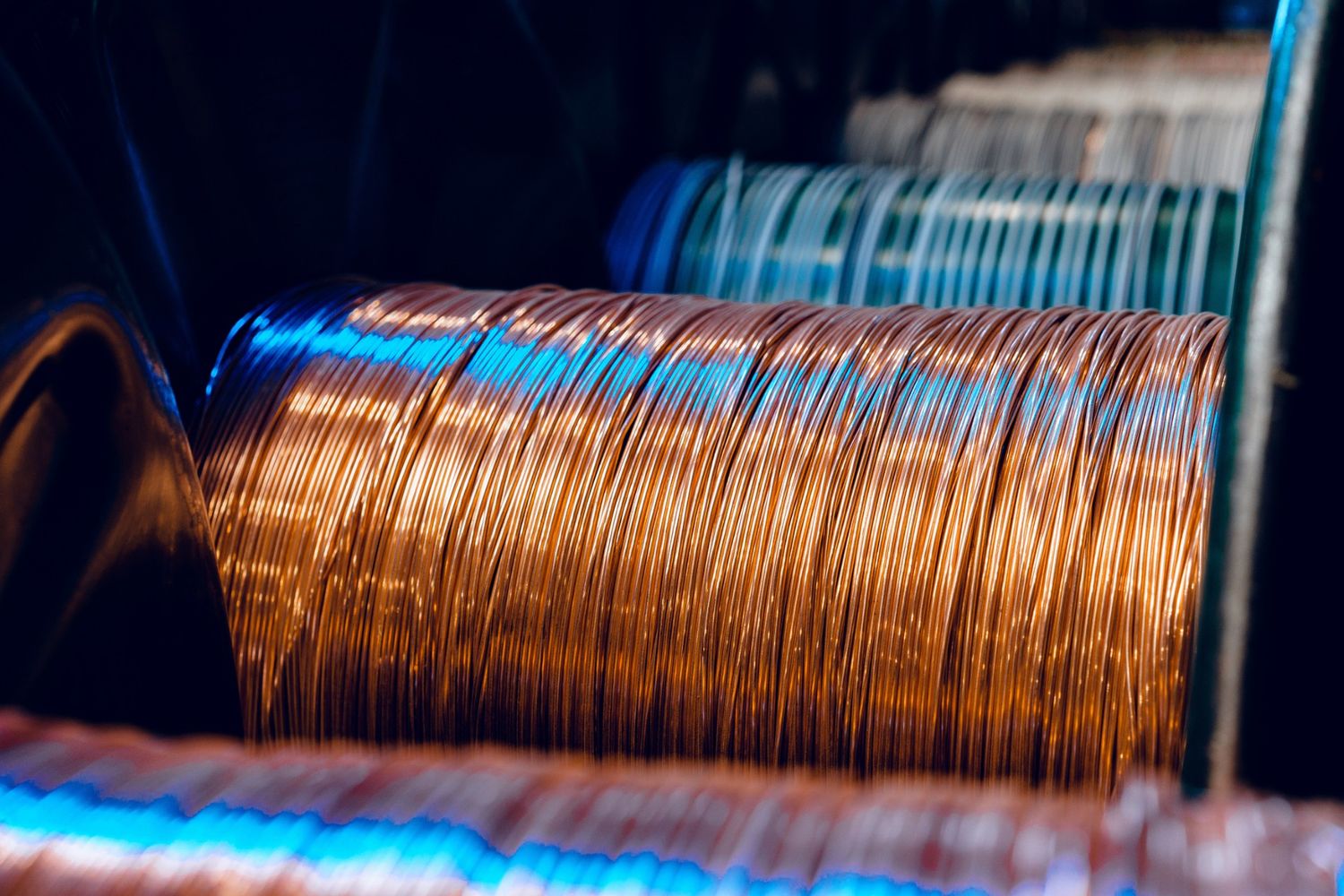

Metal commodities are physical metals traded in bulk on global exchanges. They are divided into two main categories: precious metals (such as gold, silver, and platinum) and base metals (like copper, aluminum, nickel, and zinc). While precious metals are often valued for their rarity and role in investment, base metals are primarily used in manufacturing and industrial processes.

Traders, investors, and governments closely monitor metal commodity prices, as fluctuations can significantly impact sectors such as construction, electronics, and manufacturing. The London Metal Exchange (LME) and COMEX are two of the most influential platforms where these commodities are traded.

The Importance of Metal Commodities in the Global Market

The health of the global market is deeply intertwined with metal commodities availability and price stability. For instance, copper is widely considered a barometer for global economic health due to its extensive use in infrastructure, electronics, and transportation. When copper prices rise, it often signals increased industrial activity and economic growth.

Similarly, aluminum is vital for the automotive and aerospace industries, while steel, made from iron ore, underpins the construction and manufacturing sectors. Global prices respond accordingly as demand for these metals rises, especially from emerging markets like India and Southeast Asia.

Economic Indicators

Metal commodities serve as reliable economic indicators. For example:

- Rising metal prices often reflect industrial expansion and higher construction activity.

- Falling prices may suggest reduced demand, signaling an economic slowdown or oversupply.

Central banks and institutional investors also monitor precious metals like gold closely, as they act as hedges against inflation and currency fluctuations.

Key Factors Affecting Metal Commodities

Several dynamic factors influence the supply, demand, and pricing of metal commodities in the global market:

1. Geopolitical Tensions

Conflicts or political instability in major mining regions can disrupt supply chains and affect commodity prices. Tensions in Africa or South America, where many metal reserves are located, can lead to volatility in global markets.

2. Technological Advancements

With the global shift toward renewable energy and electric vehicles, the demand for metals such as lithium, cobalt, and nickel has surged. These metals are crucial components of batteries and clean energy technologies, adding new dimensions to the metal commodities landscape.

3. Environmental Policies

Stricter environmental regulations and sustainability goals transform how metal commodities are mined and processed. Companies are now expected to meet higher ESG (Environmental, Social, Governance) standards, which can impact supply chains and operational costs.

4. Global Economic Growth

When the global economy grows, so does the need for infrastructure, transportation, and consumer goods, industries heavily reliant on metal commodities. Conversely, economic downturns tend to weaken demand and reduce metal prices.

Investing in Metal Commodities

Investors can gain exposure to metal commodities in several ways:

- Futures contracts are traded on exchanges like the LME and COMEX.

- Exchange-traded funds (ETFs) that track metal prices.

- Mining company stocks which often correlate with the underlying metal prices.

- Physical metal ownership, particularly for precious metals like gold and silver.

Each investment approach has risks and rewards, depending on market trends and investor goals.

Future Outlook

As the world transitions to a low-carbon economy, the demand for certain metal commodities is expected to rise significantly. Copper, nickel, and rare earth metals will become even more valuable due to their use in green technologies and electric vehicle production.

Simultaneously, global market volatility, trade policies, and resource nationalism will continue influencing availability and pricing. The increasing digitalization of commodity trading and the rise of artificial intelligence in forecasting and logistics will also reshape how the industry operates.

Conclusion

Metal commodities are far more than raw materials, they are foundational to economic growth, technological advancement, and global trade. Understanding their role and the forces that shape their pricing is essential for businesses, policymakers, and investors navigating the complexities of the global market.

As we move forward into a more sustainable and interconnected world, monitoring the trends in metal commodities will be vital to anticipating shifts in the global economy.