Insights

Investment Strategies for Precious Metals in the Long-Term

Dresyamaya Fiona

•

3 minutes

read

•

Jul 11, 2025

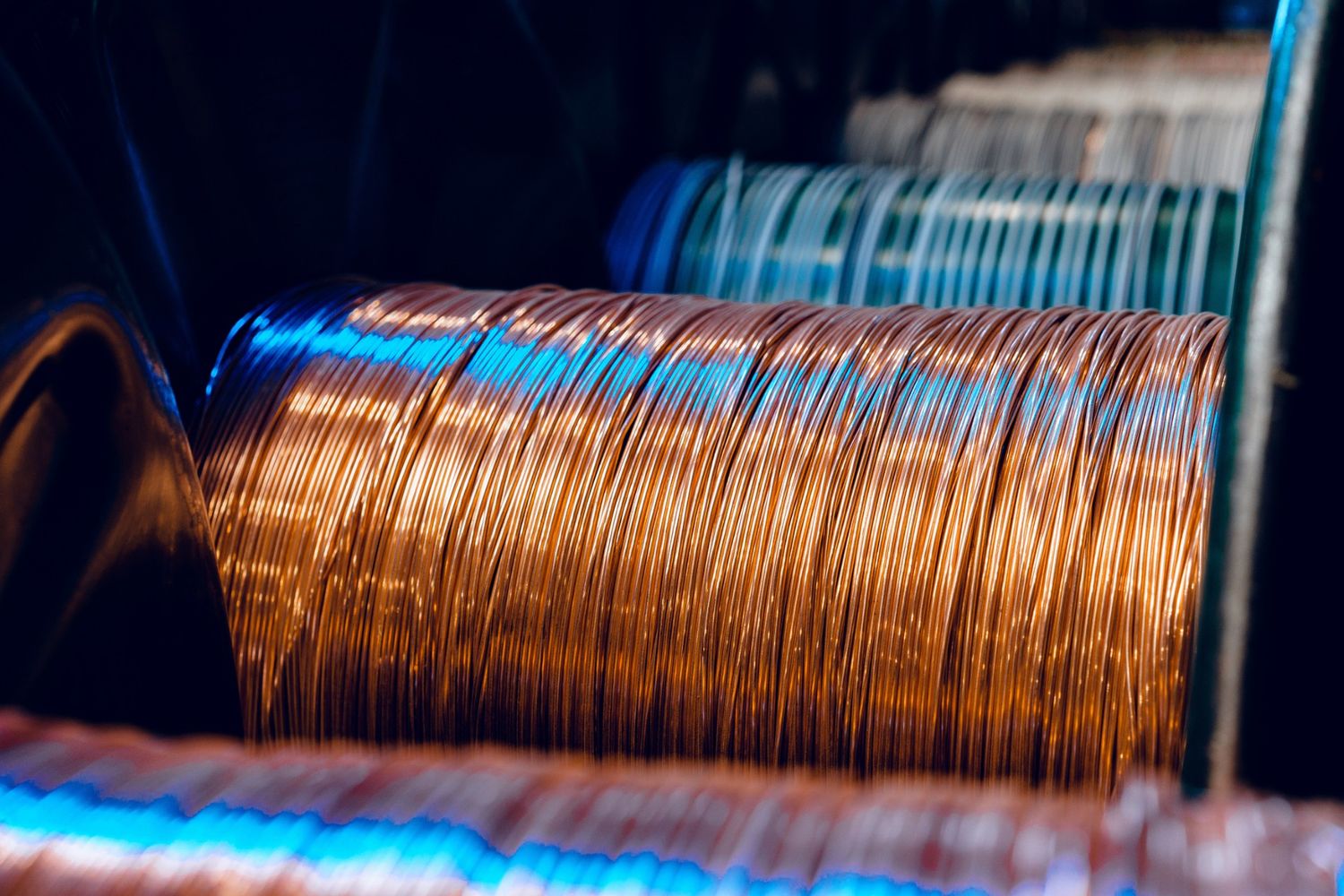

Precious metals such as gold, silver, platinum, and palladium have historically held intrinsic value due to their rarity and diverse industrial applications.

In times of economic uncertainty and inflationary pressures, many investors seek alternative asset classes to preserve capital. One such class is precious metals. But how can investors effectively integrate gold, silver, and other metals into a long-term investment strategy?

What Are Precious Metals and Why Do They Matter?

Precious metals such as gold, silver, platinum, and palladium have historically held intrinsic value due to their rarity and diverse industrial applications. They are often viewed as a hedge against inflation, currency depreciation, and systemic risk.

Common Long-Term Investment Strategies for Precious Metals

1. Physical Bullion Holding

Investors purchase physical forms, such as coins or bars and store them securely. This strategy offers tangible ownership and insulation from financial system risks but involves storage and insurance costs.

2. Precious Metal ETFs and Mutual Funds

These instruments provide exposure without the need for physical storage. They track the price movements of metals or related mining equities, offering liquidity and ease of access.

3. Mining Stocks and Equity Investments

Investing in companies that produce or explore precious metals can provide leveraged exposure to these assets. However, they carry operational and market risks that extend beyond metal price fluctuations.

4. Futures and Options Contracts

Used mainly by sophisticated investors, these derivative instruments allow speculation or hedging. They require margin accounts and an understanding of leverage and expiry risks.

These instruments are complex and typically suitable only for experienced or Accredited Investors. They carry high risk and may result in significant losses.

Benefits and Risks

Benefits:

- Diversification: Historically low correlation with traditional assets like equities and bonds.

- Inflation Hedge: Particularly gold, which often retains value during inflationary periods.

- Crisis Resilience: Metals may perform well during geopolitical or financial crises.

Risks:

- Volatility: Precious metals can experience significant short-term price swings.

- No Yield: Unlike stocks or bonds, they do not generate income.

- Market Timing: Entry and exit timing can affect long-term returns.

Tips for Building a Precious Metals Portfolio

To successfully integrate precious metals into a long-term investment strategy, consider the following best practices:

1. Determine Your Allocation

According to The Economic Times, some financial commentators suggest a 10–15% allocation to precious metals, but individual circumstances vary. The allocation should depend on your risk tolerance, financial goals, and market outlook. Overexposure can reduce portfolio growth, while underexposure may limit the protective benefits of the portfolio.

2. Diversify Within Metals

Don’t put all your eggs in one basket, so to speak, by focusing solely on gold, silver, platinum, and palladium, which offer different risk-reward profiles due to their unique industrial applications and supply-demand dynamics.

3. Balance Physical and Paper Assets

Investors may choose to balance physical and paper-based holdings depending on their own goals and risk appetite.

4. Review Regularly, but Avoid Overreacting

Precious metals are volatile in the short term. Stay focused on your long-term strategy and avoid making emotional decisions based on daily price fluctuations.

5. Understand Tax Implications

Different precious metal investments may be taxed differently. For example, physical bullion in many jurisdictions is taxed as a collectible, often at a higher rate. Consult a tax advisor to ensure compliance and efficiency, as tax regulations vary by country.

Conclusion

Precious metals can play a valuable role in a well-diversified long-term investment strategy, especially during periods of economic uncertainty, inflation, or market volatility. Whether through physical ownership, financial instruments, or equity investments, these assets offer both protection and potential upside.

However, like any investment, they require careful planning, ongoing evaluation, and an understanding of the associated risks. By approaching precious metals with a balanced and informed strategy, investors can benefit from their historical role as a diversification tool, though outcomes may vary depending on market conditions.

DISCLAIMER: All information is based on sources believed to be reliable, but accuracy is not guaranteed. This content is not an offer, recommendation, or advice to buy or sell any financial products. Investing involves risks, and past performance does not guarantee future results. Advice should be sought from a financial adviser regarding the suitability of any investment product or service you may wish to purchase or subscribe to.